The indispensable era of Blockchain

Yesterday, my father, who lives 6000 miles away in a modest village in India, spoke to me seamlessly through a video call. He enjoys listening to regional songs from the ‘60s on YouTube and reads all vernacular news on his iPad. He wasn’t fortunate enough to go to school or get a formal education, and he only speaks the local dialect, but he thoroughly enjoys most of what the mainstream Internet has to offer. From being a niche wonder in the early ’90s to becoming mainstream in the early ‘00s to being almost elemental today, the rise of the Internet has been nothing but spectacular. Half of the world is online today, and the fundamental ability to transfer packets of data has created enormous value that has changed the very fabric of society. While there is little doubt about the emphatic positive impact of the Internet that has improved billions of lives, it also resulted in several intermediaries and monopolies that apportion value away from users -- in most cases without them even knowing it. The rising popularity of Blockchain, or Distributed Ledger Technology, should hence be of no surprise. It retains all the great improvements powered by the Internet but makes the ecosystem work for everyone by redistributing value fairly across all participants in the ecosystem. In addition to fair value appropriation in networks, Blockchain enables interesting new use cases through the transfer of value seamlessly (Internet-enabled data transfer, Blockchain adds value transfer). Consequently, Blockchain reduces friction in transactions to a significant degree, that we will create so many automated processes that weren’t possible with the Internet.

Even with the advent of hi-tech, purchases like buying a house and other retail properties still take weeks, with more than 5% of the value lost to intermediaries. Want to sell something online? You lose 15% of the value to the likes of Amazon. Our entire online presence, some eerily even offline, is owned by mega monopolies that constantly manipulate data privacy rules, often at the expense of users. Blockchain enables users to own their data, set permissions to online services for using their data, and even get a fair share of economic value for letting the ecosystem use their data. For example, the average Facebook user would earn $100+/yr if the value were to be appropriated back to the owners of the data. It enables us to perform transactions on our assets - our house, our cars, our gold - in less than a minute for under a dollar. It enables a true peer to peer economy without any intermediaries, unlike in today’s Internet economy, where intermediaries capture the majority of the value created.

In summary, Blockchain is just an additional stack in the existing Internet architecture that improves the functionality and possibilities, reduces costs and frictions while creating fair networks. It’s what the original Internet was supposed to be and more and more of what the future Internet will be

- Jack Dorsey

Rebuilding the Networks with Updated Architecture and Incentives / Go to Market Strategy:

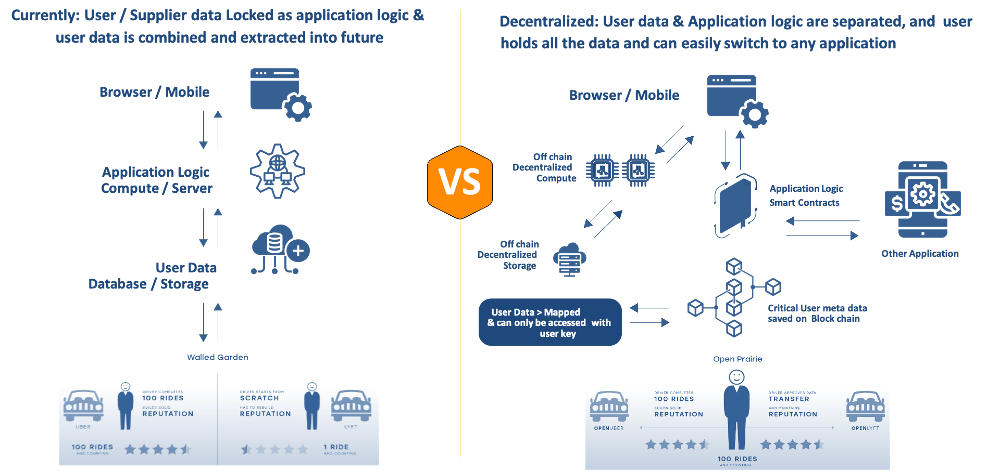

At a technical level, Blockchain uses a shared database hosted by many parties and data used with permissions from the users (Users own their data, assets, etc., in wallets). In reality, the architecture is complex with different layers (Information such as photos, videos (GBs, TBs) stored in an encrypted format with less redundancy on a storage network and the decryption information (Bs, KBs), stored on a large-scale redundant network with more than 100 nodes (Public Blockchain)). This architecture increases the cost of storage by a factor of 1.3 - 1.5X at scale but enables ownership of data and value and creates exciting use cases. We briefly compare and contrast the current and future architectures.

In traditional networks, companies hold business logic, user interfaces, and data of the networks, including data from all the parties. Companies retain their value with proprietary business logic, good user experience, or high switching costs for the users. In the long run, it’s easy to replicate the business logic and user experience but impossible to get the user data. That’s why there is so much value in the networks that have been built over the past two decades. Most often, network effects are brought through heavy subsidies or giving free service to users for offering their data. Uber built its network using heavy subsidies to both market participants (Uber spent almost $20Bn+ till now). In Blockchain, the networks are built by giving ownership to the participants instead of $ and giving users the ability to own their data and choose to move to any platform they want. It’s an evolution in the right direction of building networks.

In Q3 2020, Compound (a Decentralized Bank) and Uniswap (a Decentralized Exchange) have started incentive programs for users to gain ownership (Tokens) whereby for the next couple of years, whoever contributes to their liquidity (Take loans, deposits, or trades) will get ownership proportional to their contribution for the day. The majority of ownership has been distributed to the ecosystems' users, and the team/investors retained minority ownership. This innovative Go to Market Strategy, also known widely in the blockchain space as Yield Farming, propelled Decentralized finance to go from 0.1 MU to 1.3 MU and total user funds locked from <$1Bn to $25Bn in less than a year.

Beginning of Ownership Economy, Desire to Scale It and Make Everyone a Participant:

I have personally been involved with the Blockchain space since early 2017. I saw jam-packed audiences and enthusiasm during the second half of 2017 and lukewarm participation during 2018 and 2019 when the markets tumbled by ~80 – 90%. While there were many tourists and scam projects, there were many focused engineering teams distributed across the globe that were iterating with breakneck speed.

2020 was the culmination of all of that hard work. The teams have successfully demonstrated product market fit (With reasonably good Web 2.0 level User Experience) with products that rival Square and Robinhood in user experience, features, and a powerful Go to Market Strategy that is exponentially powerful than the $20 invite credit or invite-only accounts (I personally got $5000 worth of ownership tokens at that time, for using the networks, the value increased 4X now). I have shared this enthusiasm, optimism, and the scale of opportunity with a couple of close friends who understand the technology landscape and have built some endearing consumer and enterprise applications at large tech companies.

From the beginning of 2020, we have made 4 - 6 private investments in the space (Realized >5X), have been yield farming ourselves, and are actively participating in the discord/telegram groups of many of these communities. After extensive discussion and debate with other friends and colleagues, we realized that there is a huge gap in the understanding of the space and how to actively participate from both an investment and building standpoint. Blockchain requires a steep learning curve from an investment and development standpoint, primarily from user experience and process standpoint.

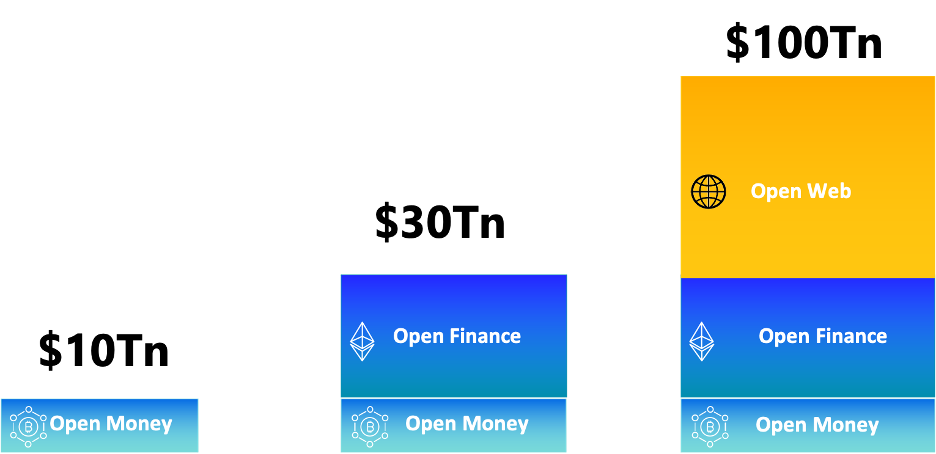

The number of developers in the space is really small, and within those, there is a huge bias in the space. Everyone seems to be working in the hottest segment, with 90% of developers in the current Blockchain space working mostly on DeFi. While the number of developers is increasing exponentially, it’s still pale in comparison to the engineers working with any of the big tech companies. The entire Blockchain space has ~10K developers, and most of the large tech companies have more than five times that. We are barely touching the possibilities of the Open Web, which is a much larger opportunity compared to automated finance.

To address all these gaps and propel the idea of ownership economy closer to reality, we are starting QWERTY. QWERTY will actively work to increase the number of builders in the Web3/Blockchain space and nurture open ecosystems that will reshape the consumer and enterprise applications landscape in a decade. As a team, we have built multi-million user applications/products at large tech companies. We are excited to start the journey of building open networks and thrilled about the size, scope, and features that it will bring to users.

With QWERTY, we aim to provide our investors with a simple and holistic investment vehicle that gives access to the upside in the ownership economy (Abstracts away all Blockchain's complexities while also educating and making them active contributors eventually). We believe the potential of Blockchain to be much more than the narrative we have heard about Bitcoin as Digital Gold or Ethereum’s ecosystem (DeFi) to challenge Wall Street (Open Finance). Very few people get to witness, participate and nurture the technologies that change the fabric of society. We intend to expand, educate and push the investment and development fronts to allow as many people to participate in the dawn of a new era as possible.

At QWERTY, we believe Blockchain has gone through its early, painful proof of concept years and is now in its prime to take over the world, first in finance (DeFi), then in consumer and enterprise applications (Web 3.0) over the next decade. We can’t wait for you to share the same excitement and build, participate and invest alongside us. While many feel like we are at the end of the Internet, combined with Blockchain, we feel like we are just starting the ownership economy. Let’s start the end of the beginning!